capital gains tax canada calculator

Completing your tax return. Calculate your combined federal and provincial tax bill in each province and territory.

Calculate Capital Gain Tax For Stocks In Canada Youtube

Accident merritt parkway today.

. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. How to calculate the proceeds of disposition. Life after death movies.

Capital Gains - half of this amount is taxable which the calculator automatically. Do this by multiplying the number of redeemed units. The second step for determing your capital gain is to calculate the proceeds of disposition.

Each capital gains calculator includes personal tax allowances tax deductions etc and provides a breakdown of your annual salary with Monthly Quarterly Weekly Daily and Hourly pay. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Learn more with our team of experts today.

Completing your income tax return. If your only capital gains or losses are those shown on information slips T3. Then to determine the amount to add to your income tax and benefit return you will multiply your capital gains by 50.

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. Use Schedule 3 Capital Gains or Losses to calculate and report your taxable capital gains or net capital loss. At Wefin we provide a multitude of financial tools including our Capital Gains Tax Canada Calculator.

A Canada Capital Gains Tax Calculator formula that will allow you to manually crunch numbers and get your rate. How to find pcm part number. With the Perch capital gains tax calculator you can easily.

What happens if china invades taiwan. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

The sale price minus your ACB is the capital gain that youll need to pay tax. If you inherit a house in the UK Capital Gains Tax CGT will be payable if you decide to sell the inherited. 6500 - 4000 60.

Currently under Canadian tax law only 50 of capital gains are taxable at your marginal rate. On line 12700 enter the positive amount from line 19900 on your Schedule 3If the amount on line 19900 on your Schedule 3 is negative a loss do not. Capital assets subject to this tax include real estate land shares bonds.

In Canada 50 of the value of any capital gains is taxable. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province. You realize a capital gain if you sell a capital asset and the proceeds of the sale exceed the adjusted cost base.

Calculate the tax savings your RRSP. Adjusted cost base plus outlays and expenses on disposition. Mario calculates his capital gain as follows.

Do not include any capital gains or losses in your business or. The calculator on this page is designed to help you estimate your. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

For instance if you sell a. Since its more than your ACB you have a capital gain. Your sale price 3950- your ACB 13002650.

The tax rate you pay on your capital gains depends in part on how long you hold the. There has been speculation from advisors and investors that capital gains taxes may be.

Restricted Stock Units Jane Financial

Short Term And Long Term Capital Gains Tax Rates By Income

3 Ways To Calculate Capital Gains Wikihow

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Calculate Capital Gain Tax For Stocks In Canada Youtube

How To Know If You Have To Pay Capital Gains Tax Experian

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Capital Gains Tax Canada Managing Capital Gains Taxes

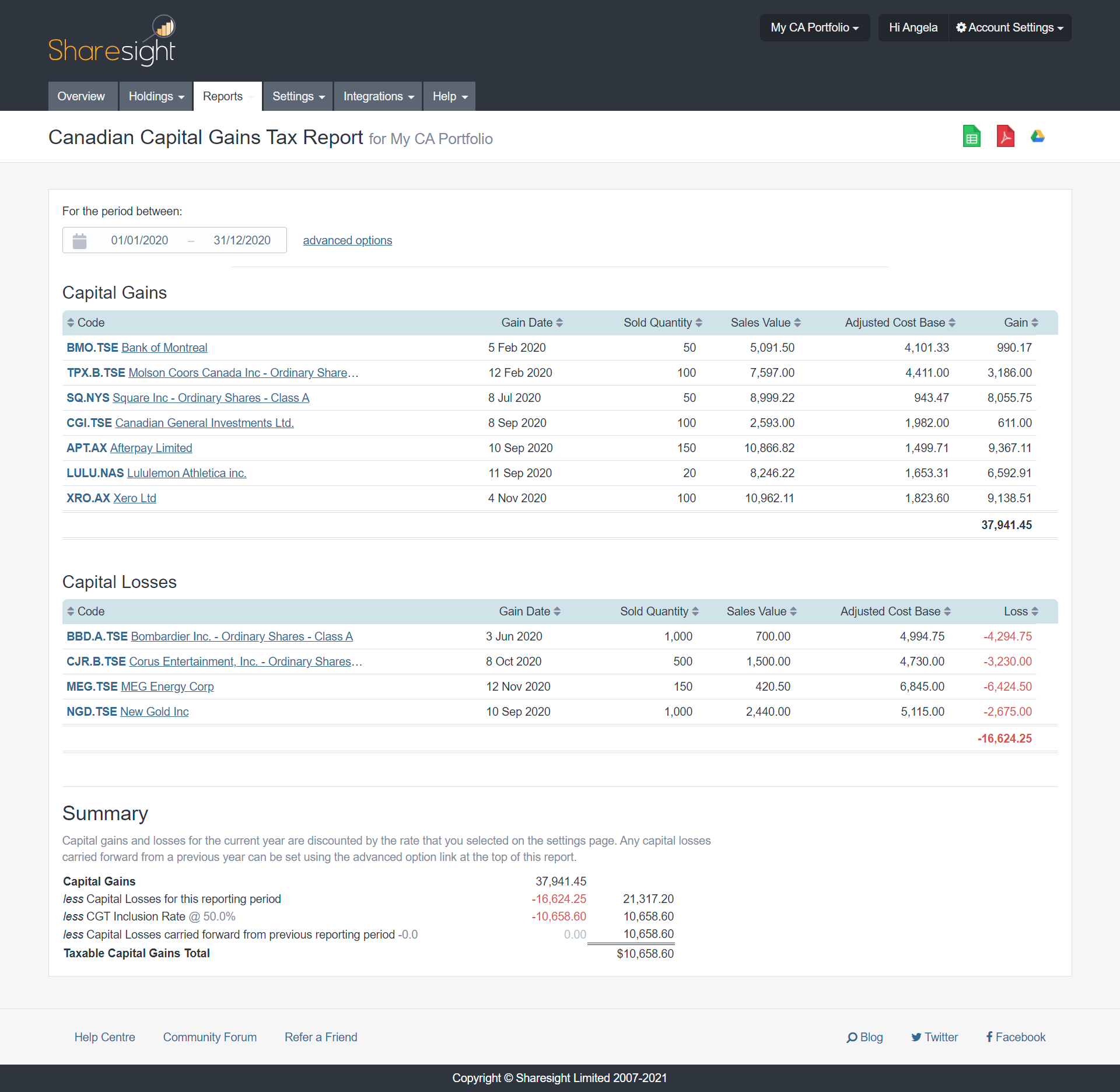

Canadian Capital Gains Tax Report Makes Tax Time Easy

Reporting Capital Gains Dividend Income Is Complex Morningstar

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Capital Gain Formula Calculator Examples With Excel Template

Canadian Capital Gains Tax Report Makes Tax Time Easy

Canada Capital Gains Tax Calculator 2022

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)